The promissory note requires each months interest to be paid on the last day of each month. Assets Liabilities Equity.

Understanding Company Accounts Corporate Watch

Withdraw money from your company thats not part of your salary an expense or a dividend and the amount is more than you invested.

. Include any money you owe the company or the company owes you on the balance sheet in your annual accounts. DEFERRED TAXATION The annexed notes form an integral part of these financial statements. However due to the payment process and cash flow issue the payment is delayed.

The note also requires the company to make annual principal payments of 40000 on December 31 of 2022 2023 and 2024. It can also be referred to as a statement of net worth or a statement of financial position. Tax on loans You may have to pay tax on directors loans.

It is used to prepare financial statements. If there is a balance owing to any director at the companys year-end this can result in an income tax and national insurance liability for the directors concerned not forgetting that the company will also be required to pay Employers NI as wellSalary can be paid to the Directors Current Account if there is still an outstanding balance owing to the company but. Where there is more than one Director in the.

The benefit is reported on the directors Self Assessment return. The Buyer agrees that the Seller shall have the right at any time to complete and register a mortgage over any interest in property owned by the Buyer to secure the Amount Owing and the Seller shall have the right at its discretion to place a caveat on any such property for the purposes of this clause and the Buyer irrevocably appoints the Seller as the attorney of the Buyer for the. If you dont repay within 9 months then the company should then pay 25 of the amount owed as Corporation Tax.

The trial balance rolls up the information from the general ledger which includes all the financial accounts of a business. On the December 31 2021 balance sheet the corporations 120000 of debt is reported as follows. These will be posted to the directors loan account to reduce the amount owing to the director.

Overdrawn directors loan account. On 20 April the company has made a payment of 50000 to all directors. Company ABC has 3 executive directors and 2 non-executive directors.

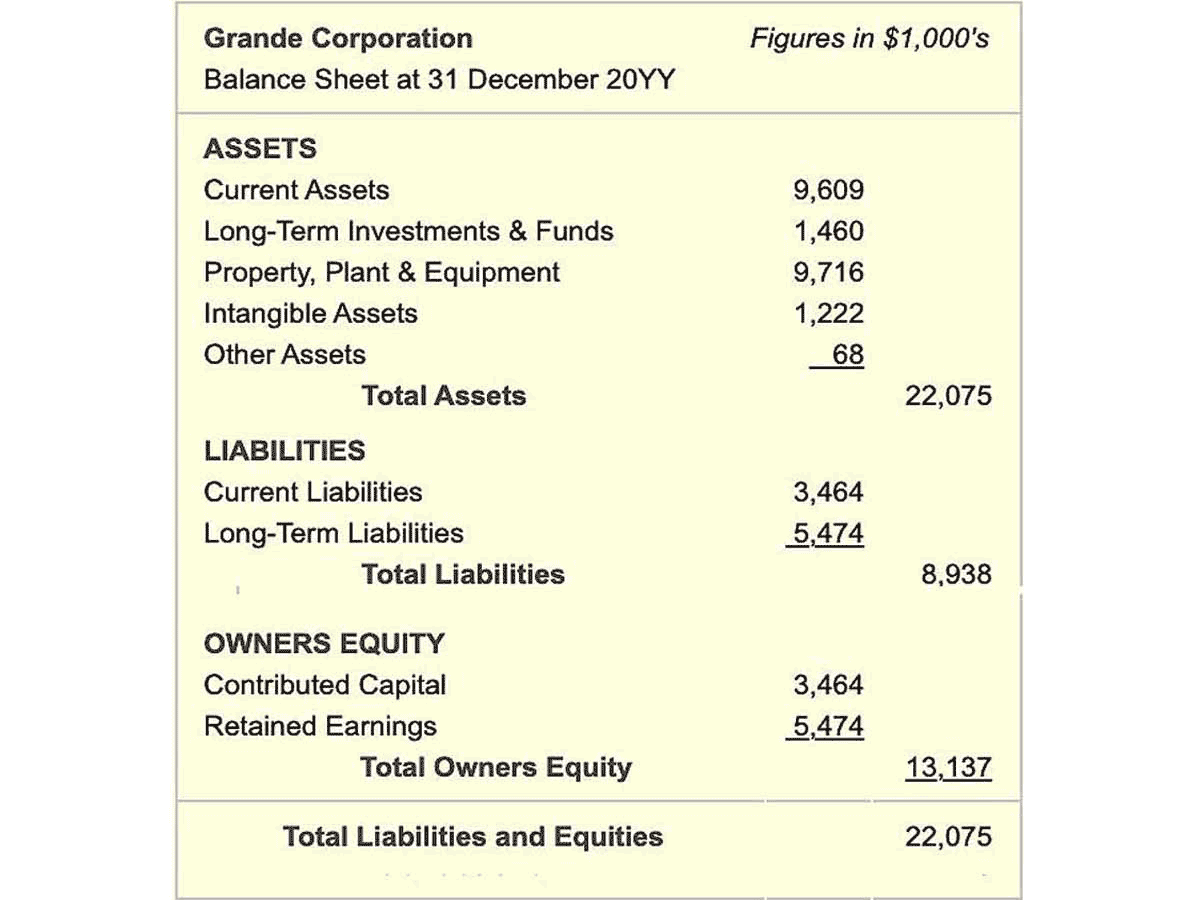

A due from account is an asset account in the general ledger used to track money owed to a company that is currently being held at another. The director will be liable to pay income tax on the cash equivalent of the benefit calculated using the average or daily method. The balance sheet is based on the fundamental equation.

Amount Due From Directors - Pay Income Tax. If you only pay back part of the directors loan within 9 months of your companys year-end then youll have to pay tax on the remaining balance. Tax is charged on the remaining balance.

CFIs Financial Analysis Course. The DLA is a balance sheet. AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment.

Lets look at an example. This does not go in the abbreviated accounts if you do those for Companies House - only debit balances go in there. The amount owed to or from the director.

Youll need to use the CT600A form to show the amount owed. On 01 April the remuneration committee decide to pay the 10000 to each director. The balance sheet displays the companys total assets and how the assets are financed either through either debt or equity.

Amounts owed to directors are just included in Other Creditors but as you say must be included in the Related Party Transactions note stating the nature and amount of the transactions and the year-end balance. The ledger is divided into two columns. Balance sheet - amount due from directors.

Directors Loan Account transactions. Directors will often draw irregular cash sums against the DLA in advance of wages being calculated and dividends being declared. In laymans terms if your Company has Amount Due From Directors you have to calculate an interest income for the Company based on the outstanding.

If loans to a director exceed 10000 a taxable benefit arises unless the director is charged interest at or above the Official Rate. Liability accounts are accounts that show the amount of money that is owed by the business.

Balance Sheet Example The Law Student Blog

How To Put Balances To Manager S Profit Loss Account Items Manager Forum

Projected Balance Sheet Bowraven Limited Small Business Software Solutions

Balance Sheet Explained Maslins Accountants Maslins Accountants

Everything There Is To Know About Accounts Payable

Director S Loan Account Lending Your Company Money Inniaccounts

Owners Equity Net Worth And Balance Sheet Book Value Explained

How To Read A Balance Sheet Complete Overview

Balance Sheet Provides Insights For Debt Collection

Balance Sheet Ratios Types Formula Example Accountinguide

Understanding Company Accounts Corporate Watch

How Do I Read A Balance Sheet What Shows If A Company Is Strong Or Not This Is Money

How To Calculate Total Assets Definition Examples

Owners Equity Net Worth And Balance Sheet Book Value Explained

The Balance Sheet Accounting 4 Business Studies Students